Securing Section 8 company registration can seem like a daunting challenge, but with the right understanding, it's a process that can be managed effectively. This thorough guide will walk you through every the essential steps involved, providing you with the tools needed to efficiently register your enterprise.

First, let's delve foundations of Section 8 companies and what they function. Understanding this system is crucial for making informed decisions throughout the registration.

Then, we'll outline required steps involved in registering your Section 8 company, including submitting the essential paperwork and meeting all relevant requirements.

Finally, we'll provide practical advice to ensure a smooth registration procedure. By following this guide, you'll be well on your way to effectively navigating the Section 8 company registration process.

Establishing a Non-Profit Organization: A Step-by-Step Guide

Embarking on the journey of founding a non-profit organization can be both rewarding. To ensure a smooth and successful process, it's essential to comprehend the registration necessities involved. This detailed guide will walk you through each step of registering your non-profit, demystifying the process and empowering you to make a positive contribution.

- First defining your organization's mission and goals. This will serve as the foundation for your non-profit's activities and shape its future endeavors.

- Formulate a detailed operational plan outlining your programs, services, intended recipients, and resource allocation. This document will be crucial for attracting supporters and demonstrating your organization's viability.

- Gather a dedicated board of directors. Your board should consist of individuals with diverse skills, experience, and views who are passionate about your organization's mission. They will play a vital role in guiding the organization's trajectory.

- Select a suitable legal structure for your non-profit. The most common options include incorporation as a 501(c)(3) organization, forming a public charity, or establishing a private foundation. Consult with an attorney to determine the best structure that aligns with your organization's objectives and legal requirements.

- Register your non-profit's articles of incorporation with the appropriate state agency. This establishes your organization as a separate entity. You may also need to procure other permits or licenses depending on your operations.

- Submit an application for 501(c)(3) status with the Internal Revenue Service (IRS). This designation grants your organization federal tax-exempt status, permitting it to receive charitable contributions.

Keep in mind that the registration process can be complex and time-consuming. It's essential to conduct thorough research, seek professional advice, and adhere to all applicable regulations. By following these steps, you can effectively establish your non-profit organization and make a difference.

Creating a Limited Liability Partnership: A Step-by-Step Process

Deciding to launch a business as a limited liability partnership (LLP) is an significant decision. To ensure a smooth and successful process, it's crucial to follow a well-defined set of steps.

- Firstly, carefully draft a comprehensive partnership agreement that clearly defines each partner's roles, responsibilities, profit sharing arrangements, and other key terms.

- Secondly, select a suitable name for your LLP. Ensure it's distinguishable from existing businesses and complies with the naming regulations of your jurisdiction.

- Subsequently, file the necessary paperwork with the designated government authority. This typically involves submitting a partnership registration along with the required fees.

- Finally, obtain an Employer Identification Number (EIN) from the IRS, which is essential for tax purposes.

Keep in thought that specific requirements may vary depending on your location. It's always recommended to consult with a legal professional or business advisor to ensure you comply with all applicable laws and regulations.

Embracing Entrepreneurship: One Person Company Registration Simplified

Starting your own business can feel daunting, but it doesn't have to be. With a little guidance and the right resources, you can navigate the often-complex world of company registration with ease. A one-person company, also known as a sole proprietorship or partnership, offers a flexible click here and straightforward structure for individuals looking to launch their entrepreneurial dreams. By understanding the essential steps involved in registering your one-person company, you can lay a strong foundation for your future success.

- First and foremost, it's crucial to choose a unique and memorable name for your company. This name will be your brand identity and should reflect the nature of your business.

- Following that, prepare to for registration. These may include personal identification, proof of address, and a detailed company description.

- After gathering your documents and registration fees, you can submit your application online or through the appropriate government agency in your jurisdiction.

Throughout this process, it's always a good idea to consult with a legal professional or business advisor for personalized guidance. They can help you navigate any complexities and ensure that your registration is properly filed. By following these simple steps, you can confidently embark on your entrepreneurial journey.

Legal Structures for Social Impact: Understanding Section 8 Companies and NGOs

Embarking on a journey to foster social impact, it's crucial to identify the appropriate mechanism. Two prominent options are Section 8 Companies and Non-Governmental NGOs. Section 8 Companies, also known as Benefit Corporations, prioritize both profit generation and social goal, incorporating a commitment to positive change within their core values. Conversely, NGOs are typically established with a purely philanthropic aim, dedicated to tackling social challenges without the drive of financial return. Understanding the distinctions between these two models can help aspiring changemakers make the best fit for their aspiration.

- Partner with experienced legal professionals to ensure your chosen structure aligns with your objectives.

- Regularly review your social influence and make adjustments as needed.

- Stay informed of evolving legal and regulatory landscapes that may affect your chosen structure.

Building a Secure Future: LLC and OPC Registration Explained

In today's dynamic business landscape, identifying the right legal structure is essential for your success. An Limited Liability Organization (LLC) or an Sole Proprietorship with Limited Liability offers noteworthy advantages that can protect your personal assets and optimize business operations.

- Establishing an LLC or OPC provides a separate legal entity, protecting your personal belongings from business liabilities. This distinction is significantly important if your enterprise involves certain uncertainties.

- Both LLCs and OPCs offer adaptable management structures, allowing you to tailor your operations to accommodate your requirements. This adaptability can be highly beneficial as your business grows.

- Formation with an LLC or OPC can also improve your business's standing. It conveys a sense of seriousness to potential clients, investors, and partners.

In conclusion, carefully determining the appropriate legal structure for your business is a pivotal step. By understanding the advantages of LLCs and OPCs, you can establish your business for long-term prosperity.

Judd Nelson Then & Now!

Judd Nelson Then & Now! Michael Fishman Then & Now!

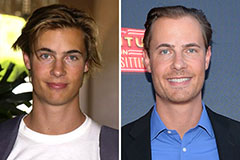

Michael Fishman Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!